Table of Contents

The need for cash can hit anyone anytime. You may be in desperate need of money to fix something around the house or make it through a sudden job loss. Whatever the reason you are here, if you are looking for the best payday day loans online, you have come to the right place!

When it comes to payday loans, there are different types of online platforms. Some will be convenient and some will take too long to process your application.

This is why borrowers should be more careful when choosing a lender. Visit UnityLoan, a leading payday loan provider with a strong reputation. Here’s an honest review about this online broker.

What is a Payday Loan?

A payday loan is a short-term loan that is borrowed for a certain amount of time. The money is usually given to a borrower in exchange for his or her paycheck or some other form of income. The money is given on the condition that it will be repaid with an added interest by the borrower’s next paycheck, which could be as soon as 15 days after receiving the advance.

These loans typically have higher interest rates than the longer-term alternatives because they are shorter-term.

But that does not imply that you should accept excessive interest rates. Applying for payday loans with no credit check on UnityLoan will connect you with lenders who offer quick approvals, quick funding, and reasonable interest rates.

Benefits of Payday Loans

Easy Application

The application process for payday loans is very simple. You just need to fill out a form and If you are eligible, you will be accepted as soon as you submit your application. Also, there is no need for documentation for this loan at UnityLoan.

Quick Approval

A payday loan could be approved within a few minutes after submitting the application, assuming your information and needs match the lender’s requirements. It is because there are fewer background checks conducted on applicants than with bank loans.

Faster Credit Check

Normally, when you apply for a loan, your credit history is one of the most important factors considered. But when applying for a payday loan online, there are no typical hard credit inquiries that happen after bank loan applications. Soft credit checks, which are frequently carried out by payday lenders and are completed through the main credit agencies, do not need much time.

More Cash Than Others

The loan amounts that can be approved are typically more than alternatives like minor cash advances from loan applications. Payday loans allow borrowers with negative credit to obtain several thousand dollars even without a cosigner.

Good Credit Not Needed

In most cases, you can qualify for a payday loan even with bad or no credit. Payday lenders focus more on your ability to pay back the money you borrow than your credit score. So long as you can afford to pay back the loan, they will give you a loan.

Types of Payday Loans at UnityLoan

Installment Loans

These loans are in place for a longer period and you can pay them back in weekly or monthly installments. They are regarded as being easier to repay because the debt is dispersed equally over a long period of time.

Same Day Loans

If you are in need of fast cash, then UnityLoan offers same-day payday loans. These loans come with affordable interest rates and are a good option for emergencies. They are loans that are disbursed to the borrower the same day they are accepted, as the name would imply. These loans call for soft credit checks, which don’t appear on the applicant’s credit report and don’t impact their FICO score.

Bad Credit Loans

These are the types of loans that are taken by borrowers with bad credit. As long as your monthly take-home salary is at least $800, you can easily qualify for them because they have simple eligibility conditions.

Fast Cash Loans

Fast cash lending providers approve loans quickly and disburse the approved loan amounts almost as quickly. They might be secured or unsecured and just minimal credit checks are required.

No Credit Check Loans

UnityLoan offers loans to people who don’t want to deal with credit checks. They are loans that don’t call for the usual intrusive hard credit checks. In its place, soft credit checks are carried out, which don’t appear on the applicant’s credit record and don’t impact their FICO score.

Personal Loans

UnityLoan also offers personal loans with various amounts which are available online. Personal loans are a type of installment loan that is given as a lump sum and paid back over time in regular installments.

Factors to Consider Before Applying For an Instant Online Payday Loans at UnityLoans

- Purpose of the Loan: It is very important to evaluate your financial situation before applying for a loan. You must make sure that you fully understand the terms of any agreement, and consider the repayment options before applying for a loan.

- Terms and Conditions: Every lender has its own set of terms and application requirements, including interest rates and processing fees. All of these terms should be carefully reviewed before making a final decision. Check with UnityLoan for details about their terms.

- Credibility: The best way to make sure that you are dealing with a reputable lender is to check out his reputation online. For example, UnityLoan is a reliable and trustworthy online payday loan platform.

- Understand the Risks: Always make sure you fully understand the risks associated with any type of loan. The liability waivers, low-cost credit and guarantee, and other terms should be carefully reviewed before making a final decision.

How to Get Payday Loans Online?

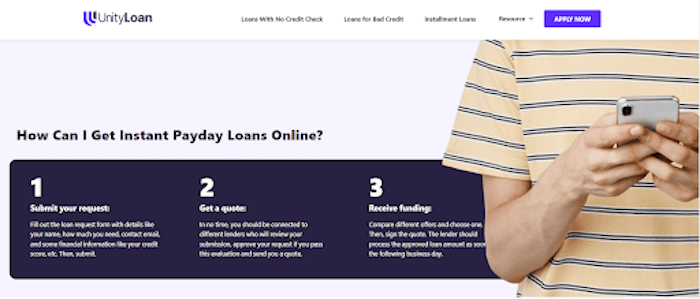

Fill the Application

Fill out the loan request form completely, including your name, the amount of the loan you need, your email address, and other financial details like your credit score.

Receive a Quote

You should quickly be connected to a variety of lenders who will analyze your application, approve it if you pass this evaluation, and provide you with a quote.

Receive Funds

Choose one after comparing the available options. After that, put your signature on the quotation. The lender ought to proceed with processing the accepted loan amount the next working day.

Conclusion

Whether you have been traditionally employed or you have been self-employed all through time, you must be familiar with the best payday loans online. However, if your bank account is running low and you need more money to meet your financial obligations for a few weeks, it should be taken in the form of a payday loan.

If you are looking for a payday loan company that offers flexible repayment terms and quick approvals, then UnityLoan can be your ally. Simply hop on their website and apply for a payday loan right away.