Table of Contents

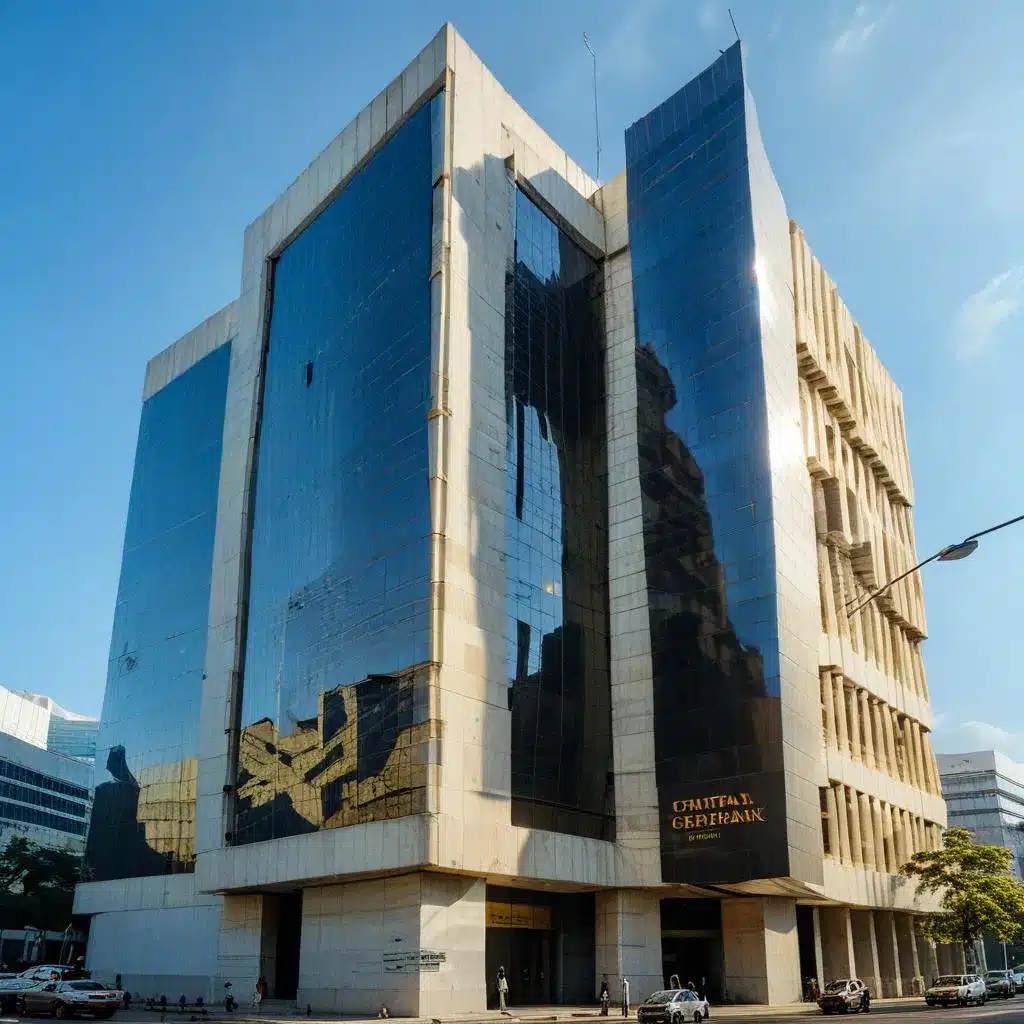

Central banks are the hidden powerhouses steering global economies. Their influence on markets is profound, often determining the ebb and flow of financial stability. Whether it’s adjusting interest rates or managing currency values, these institutions play a pivotal role in shaping the economic landscape. Understanding how central banks operate can offer a clearer view of the forces driving market dynamics and your financial future. Connecting with experts with Immediate Peak can help you understand how central banks influence market behavior, paving the way for informed investment decisions.

Monetary Policy: The Central Bank’s Primary Tool for Market Influence

Monetary policy is like the steering wheel of an economy, and central banks are the drivers. But what does that really mean? In simple terms, it’s how central banks manage money and credit to keep the economy running smoothly.

They don’t do it by chance; they carefully adjust key levers, like interest rates. Think of interest rates as the cost of borrowing money – lower rates make it cheaper to borrow, while higher rates do the opposite. If you’ve ever wondered why borrowing costs vary over time, central banks are behind the scenes making those decisions.

Let’s say a central bank notices that people aren’t spending enough money, which could slow down the economy. They might lower interest rates to make borrowing cheaper. This encourages businesses to invest more and consumers to spend more, both of which help to boost the economy. On the flip side, if the economy is overheating – meaning prices are rising too quickly – the central bank might raise rates to cool things down.

But central banks don’t just fiddle with interest rates. They also engage in something called quantitative easing. This fancy term simply means they buy financial assets to increase the money supply, hoping to encourage more spending and investment. And when they sell these assets, it’s called quantitative tightening, which has the opposite effect.

Currency Valuation and Exchange Rate Management: Central Banks’ Global Influence

Currency values might seem like a dry topic, but they’re actually quite thrilling when you think about how they affect everyday life. Ever gone on vacation and noticed how much your money is worth in a foreign country? That’s currency valuation at work, and central banks have a huge hand in it.

Central banks actively manage their country’s currency value to keep their economy stable. They do this through what’s called “forex interventions.” If their currency is too strong, it might hurt exports because other countries can’t afford their goods. On the flip side, if the currency is too weak, it can make imports expensive, leading to higher prices at home. So, central banks step in and buy or sell their own currency to keep it at a desired level.

Here’s a real-world example: In 2015, the Swiss National Bank decided to stop pegging the Swiss franc to the euro. This move made the franc shoot up in value overnight, making Swiss goods more expensive abroad. The decision had huge consequences for businesses and consumers alike. It’s a powerful reminder of how central bank actions ripple through global markets.

You might think, “Why not just let the market decide the value of currencies?” That could work, but it’s risky. Without intervention, currencies could swing wildly in value, creating uncertainty for businesses and consumers. Central banks step in to keep things more predictable, which helps everyone plan better.

Central Banks and Financial Market Stability

Central banks don’t just manage money; they’re also the firefighters of the financial world. When things start to burn, everyone looks to them to put out the flames. One of their key roles is to maintain financial market stability, which is a fancy way of saying they try to keep things calm and orderly in the markets.

Think back to 2008 during the global financial crisis. Markets were in freefall, banks were collapsing, and fear was rampant. Central banks, particularly the U.S. Federal Reserve, stepped in with emergency measures. They provided massive loans to banks to keep them afloat and cut interest rates to near zero to encourage spending and investment. This was like pouring water on a fire that was threatening to engulf the entire economy.

But central banks don’t just show up during crises. They’re always on the lookout for risks that could destabilize the markets. One of their tools is regulatory oversight. They set rules for banks and financial institutions to follow, ensuring they don’t take on too much risk. It’s a bit like a referee in a sports game, making sure everyone plays fair and follows the rules.

Yet, central banks also act as the “lender of last resort.” This means if a bank is in trouble and can’t get money anywhere else, the central bank will step in to provide support. This prevents what’s known as a bank run, where everyone tries to withdraw their money at once, potentially leading to a bank’s collapse.

But here’s a thought: Are central banks too powerful? Some argue that their ability to step in during crises can encourage risky behavior, a concept known as “moral hazard.” It’s like knowing that you can drive recklessly because you’ve got insurance – there’s less incentive to be careful.

Conclusion

Central banks are more than just policymakers; they’re the guardians of economic stability. Their decisions ripple through markets, influencing everything from the price of goods to the value of your investments. By understanding their role, you can better navigate the complexities of the financial world. Stay informed, and consider consulting with financial experts to make the most of these powerful forces in your own financial planning.