The demand for lab-grown stones in jewelry has skyrocketed. Fueled by rising fashion awareness and trends, particularly in the area of adorned accessories, they have changed the dynamics of the diamond industry. Resultantly, consumer preferences have evolved from natural to lab-made jewelry, given the availability of relatively low-cost stones.

This article discusses the factors that have caused lab-grown diamonds to become more noteworthy and preferred over the past couple of years and how they are projected to do in the near future.

International Lab-Grown Diamonds Market Overview

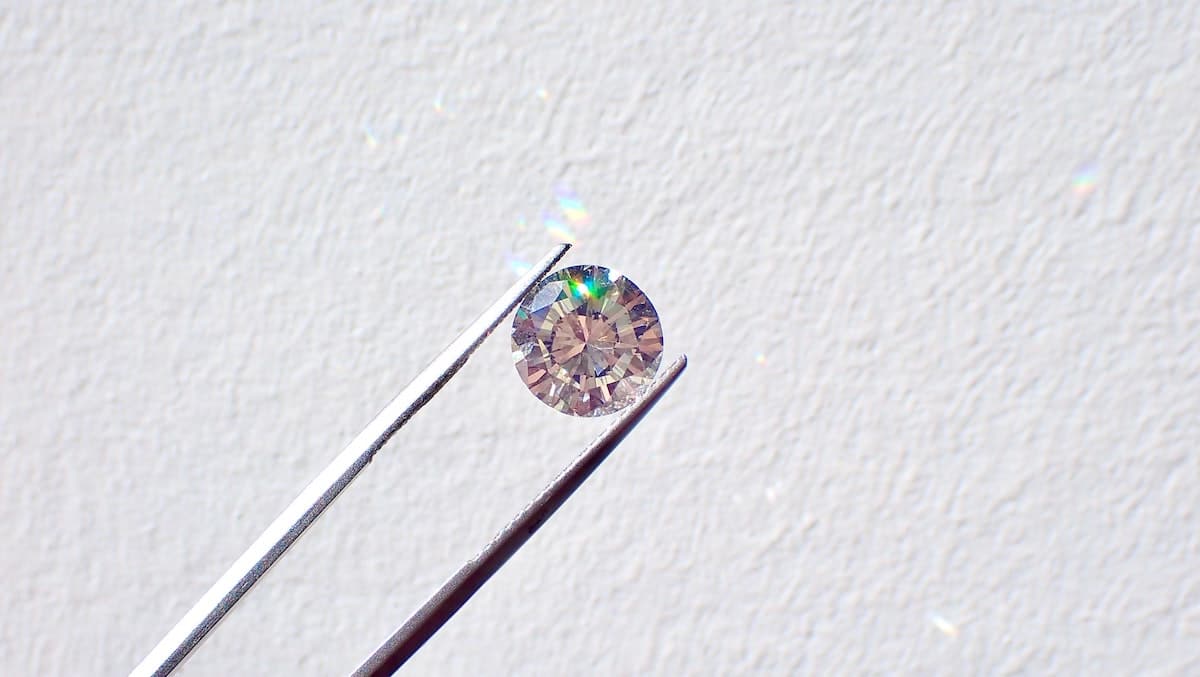

Synthetic, cultured, or cultivated diamonds are the terms used to describe lab-grown diamonds. The growing acceptance of lab-grown diamonds among the people of emerging countries is one of the critical market-driven causes driving their rise. Furthermore, global urbanization is accelerating, and a rising number of jewelry companies are transitioning to cost-effective, high-quality items like lab-grown diamonds for various purposes.

Admittedly, the expanding popularity and wide-scale uses of such diamonds in end-use sectors, such as electronics, mining, and construction, may allow many end-user businesses to enhance profitability soon. But it also benefits consumers in terms of cost-effective design that meets their needs. It is noteworthy here that global urbanization is accelerating. Therefore, a rising number of jewelry companies are transitioning to cost-effective, high-quality items like lab-grown diamonds for many purposes.

An Ascending Curve

The market has shown an unusual growth trajectory during the last five years. According to Zimnisky, before 2018, lab-grown diamond jewelry sales totaled less than $1 billion, accounting for less than 1% of the worldwide diamond jewelry market. (Although these are global figures, Zimnisky pointed out that the United States accounts for more than 90% of the market.)

According to the calculations of another industry expert, Golan, lab-grown diamonds accounted for less than 1% of all diamond sales by specialized merchants in the United States in 2018. He further claims that the figure had gone above 2% by the following year and that it continues to rise, especially as new producers, such as De Beers with its Lightbox brand, have entered the market.

Golan also opines lab-grown diamonds’ market share climbed to roughly 3.5 percent by 2020, approaching 5 percent last year, which demonstrates the ongoing rise in customer knowledge and acceptance of the product. Per this assessment, lab-grown diamonds were a $3.9 billion business in the United States in 2022.

Market forecasts from Zimnisky are more optimistic. According to his estimate, global lab-grown diamond jewelry sales would reach $5.9 billion in 2022, accounting for 7 to 8% of the total diamond jewelry market.

International Lab-Grown Diamonds Market Forecast and Trends

- Growth Drivers

The industry is boosted by the increasing growth of the construction and automotive industries since lab-grown diamonds are utilized for drilling, cutting, grinding, and polishing. Besides, governments are focusing on infrastructural development, such as transportation, water supply, telecommunications, and energy networks, thereby boosting the expansion of the construction industry.

As a result, increased construction activities, particularly in the Asia Pacific, such as “Housing for All” and the “Smart City Mission,” are expected to drive product demand throughout the projection period. The Indian government dedicated USD 92.2 billion to the infrastructure sector in the union budget for 2022-19, which will help promote overall market development.

Moreover, the cost advantage of lab-grown diamonds drives the market. Compared to natural diamonds, those grown in a lab are less expensive despite possessing similar physical and chemical attributes.

Lab-grown diamonds cannot be distinguished from mined ones by sight, touch, or other physical methods. They are free of any unethical mining difficulties common with mined diamonds, which is one reason their sales continue to rise because they promise quality and similarities.

- Restraints

Diamonds evoke strong emotions in individuals because they are seen as a symbol of prestige and luxury and are often given as gifts at important events, such as weddings and anniversaries. However, it should be admitted that lab-made diamonds cannot replace the popularity of their natural counterparts because people believe that the former is superior, but it is only because they are least aware of the latter.

Besides, people also look at diamonds as an investment option. They buy them to make more money by replacing them with lesser grade options or selling them, which is impossible with lab-grown diamonds. All of these reasons combine to impede the market for lab-made stones.

- Impact of COVID-19 on the industry

The mining industry greatly contributes to the global economy. It is responsible for delivering critical raw materials for various applications and end-use sectors, making it a crucial area of concern during the COVID epidemic. But with China’s mining sectors resuming normal operations in the first quarter of 2022, and due to similar trends in several other countries, the impacts were not detrimental.

However, market statistics tell us that the lab-grown diamond industry was least affected; no significant impact on the operations of key players, such as Swarovski and Sumitomo Electric Industries, LTD, was felt. In the middle of the pandemic, lab-made diamonds’ prices rose to USD 90 per ton, posing a threat to end-use businesses.

- Pricing and Its Effects

Research shows that lab-grown diamonds’ prices declined last year, but naturally mined ones surged by nearly 30%, expanding the difference between the two categories. However, analysts agreed that improved production/growing methods and competition among distributors would lead to the ongoing price reductions of lab-grown diamonds; it remains to be seen when their prices will bottom out.

Generic lab-grown diamonds are currently priced 75-85% lower than natural diamonds of comparable quality, according to Zimnisky. He believes that lab-grown diamonds will be priced similarly to Lightbox, which uses a size-based pricing scheme ($800 for a 1-carat diamond, $400 for a half-carat diamond, and so on). He remarked a few years ago that almost all of those lab-grown diamond sales were probably taking sales away from natural ones. This statement was issued when lab-grown diamonds were priced 10 to 15% lower than comparable natural ones.

However, now that the price disparity has increased, many consumers will choose a lab-grown diamond over a natural one of comparable grade. To put it another way, lab-grown diamonds may find new customers. However, it is argued that, in the end, market share and growth will be determined by one essential factor: marketing.

It is still a luxury product and an emotional purchase. People like how spending money is as significant a gift as a piece of diamond jewelry makes them feel, which is where the marketing comes into play, Zimnisky remarks.

Future Investment Analysis

According to these two experts, the lab-grown diamond market will continue to develop, particularly as producers increase supply and prominent retailers, including Signet and Pandora, expand their lab-grown diamond inventories.

With everything being equal, a 7 percent share in 2022 is not an unlikely scenario, Golan says. Meanwhile, Zimnisky predicts that lab-grown jewelry sales will reach $8 billion or more in 2022, accounting for around 10% of the overall diamond jewelry market, and will exceed $10 billion by 2023.