Table of Contents

In the evolving landscape of e-commerce, Buy Now, Pay Later (BNPL) services have quickly become a preferred payment method for many consumers. Offering a flexible and convenient way to make purchases without paying the full amount upfront, BNPL has transformed how people shop online. With its growing popularity, BNPL is not only reshaping consumer spending habits but also providing retailers with a valuable tool to drive sales and improve customer satisfaction.

From its roots as an alternative to traditional credit cards, BNPL has rapidly grown into a multi-billion-dollar market. As more consumers gravitate toward e-commerce, BNPL services are playing a critical role in making online shopping easier and more accessible. In this article, we will explore how BNPL is changing the way we shop online and why its adoption is increasing so rapidly.

The Rise of BNPL in E-Commerce

BNPL services allow consumers to divide the cost of a purchase into smaller, interest-free payments, typically spread over a few weeks or months. This option is appealing for shoppers who may not have the funds to pay for an item upfront or who prefer to manage their finances more flexibly. Unlike traditional credit cards, BNPL typically involves little to no interest if payments are made on time, making it a cost-effective alternative for consumers looking to avoid accumulating debt.

In recent years, the BNPL market has exploded, with its global market size reaching US$6.13 billion in 2023. The Asia-Pacific region, in particular, has embraced BNPL services, accounting for US$120 billion in the same year. Online transactions make up 65% of BNPL revenue, highlighting the strong connection between BNPL and e-commerce growth.

This trend shows no sign of slowing down, as more consumers demand flexible payment options, especially for online purchases. E-commerce platforms are integrating BNPL at checkout, allowing customers to complete their purchases without worrying about paying the full price upfront.

Boosting Consumer Confidence in Online Shopping

One of the most significant ways BNPL is changing the online shopping experience is by boosting consumer confidence. For many shoppers, the option to pay later or split payments over time makes it easier to justify larger purchases, particularly for big-ticket items like electronics, furniture, and fashion. Consumers no longer have to wait to save up for expensive items, as BNPL allows them to buy what they want now and pay for it over time.

This flexibility encourages consumers to shop more frequently and make larger purchases, knowing they can manage the payments more easily. For example, a shopper looking to buy a $1,200 laptop might be hesitant to pay the full amount upfront. However, with BNPL, they can split the payment into four interest-free installments of $300, making the purchase feel more manageable and less overwhelming.

Greater Transparency and Flexibility

One of the main appeals of BNPL services is the transparency they offer. Unlike credit cards, which can come with hidden fees or high-interest rates if balances aren’t paid off, BNPL provides a clear breakdown of payment amounts and schedules at the time of purchase. Consumers know exactly how much they will pay and when, giving them greater control over their finances.

Additionally, BNPL services often have straightforward approval processes that don’t require detailed credit checks. Many consumers are approved instantly at checkout, which makes it easier for them to complete their purchase without facing obstacles. This quick and simple process enhances the overall shopping experience, particularly for those who may not have access to traditional credit cards or who want to avoid the long-term debt associated with revolving credit.

Catering to Younger Shoppers

BNPL is especially popular among millennials and Gen Z shoppers, who tend to favor digital solutions over traditional banking products like credit cards. These younger consumers are more likely to prioritize convenience and flexibility when it comes to managing their finances. BNPL fits perfectly into this preference, allowing them to make purchases while maintaining control over their budgets.

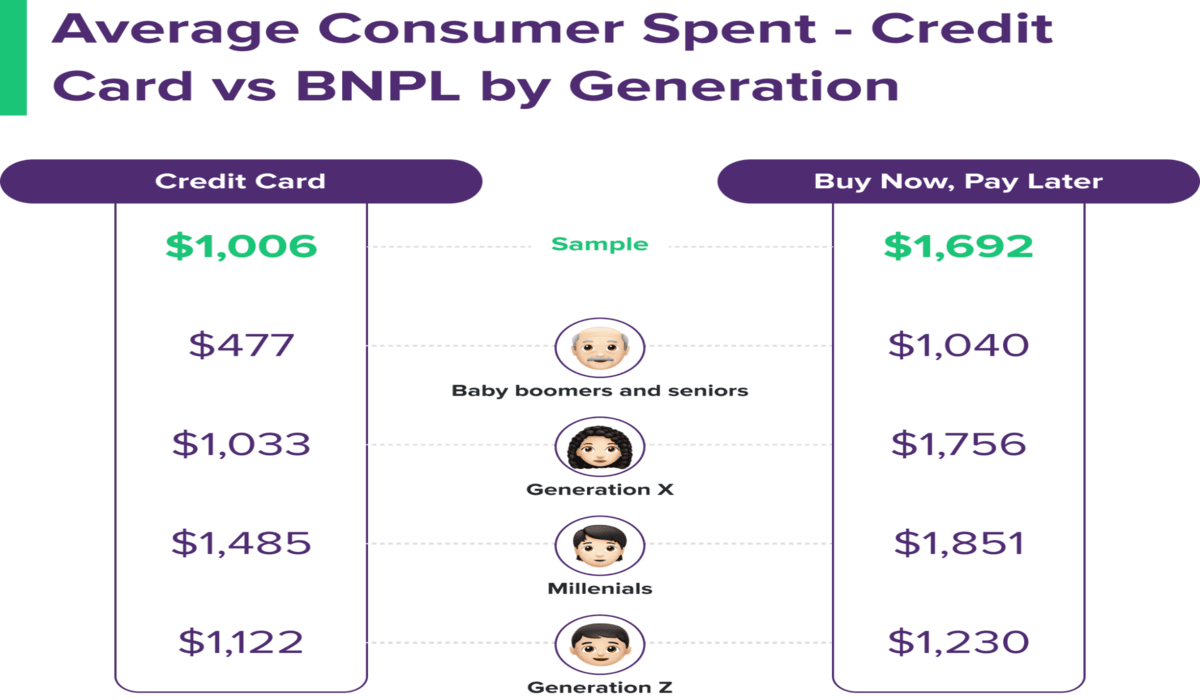

According to recent data, millennials and Gen Z consumers make up the majority of BNPL users. A study showed that millennials spend an average of $1,851 using BNPL, while Gen Z shoppers spend around $1,230. These younger generations are driving the growth of BNPL as they embrace this modern, flexible payment solution that aligns with their online shopping habits.

The data highlights how younger consumers are opting for BNPL over traditional credit cards. This shift is changing the dynamics of online shopping, as retailers look to cater to the growing demand for flexible payment options among this key demographic.

Increasing Conversion Rates for Retailers

BNPL doesn’t just benefit consumers—it’s also a game-changer for retailers. By offering BNPL as a payment option at checkout, businesses can increase their conversion rates and reduce cart abandonment. Many online shoppers abandon their carts when they see the total price and realize they can’t pay for everything upfront. BNPL removes this barrier by allowing shoppers to pay over time, which encourages them to follow through with their purchase.

In fact, research has shown that retailers offering BNPL options see an increase in average order value and higher conversion rates. Consumers are more likely to complete their purchases and spend more when they have the option to break up the payment into smaller amounts. This is particularly useful for retailers selling high-priced items, as BNPL gives consumers the confidence to make larger purchases without worrying about immediate financial strain.

Transforming the E-Commerce Experience

Overall, BNPL is transforming the online shopping experience by making it more accessible, transparent, and consumer-friendly. For shoppers, BNPL offers a flexible and affordable way to manage their purchases, while for retailers, it provides a valuable tool to boost sales and improve customer satisfaction.

As the demand for BNPL continues to grow, more retailers are integrating this payment option into their platforms, further enhancing the e-commerce experience. Whether you’re buying a new phone, booking a vacation, or upgrading your home, BNPL makes it easier to get what you need while managing your budget more effectively.

Conclusion

Buy Now, Pay Later services are revolutionizing the way we shop online. With their flexibility, transparency, and accessibility, BNPL options have empowered consumers to make purchases on their terms, without the burden of traditional credit. Younger generations, in particular, are driving the shift toward BNPL, changing the dynamics of e-commerce in the process.

For both consumers and retailers, BNPL is proving to be a win-win solution that enhances the shopping experience and boosts sales. As this trend continues to grow, we can expect BNPL to become a dominant payment method in the online retail space, shaping the future of e-commerce for years to come.

This report was first published by ROSHI, a fintech leader in Southeast Asia. Specializing in same day urgent cash loans, ROSHI is a trusted platform for Singaporeans seeking consumer lending services. Offering everything from home loan comparisons to the latest personal loan rates, ROSHI is committed to addressing the diverse financial needs of Singaporean consumers. For more information click here