Table of Contents

From a most insignificant beginning to become a Global Tycoon

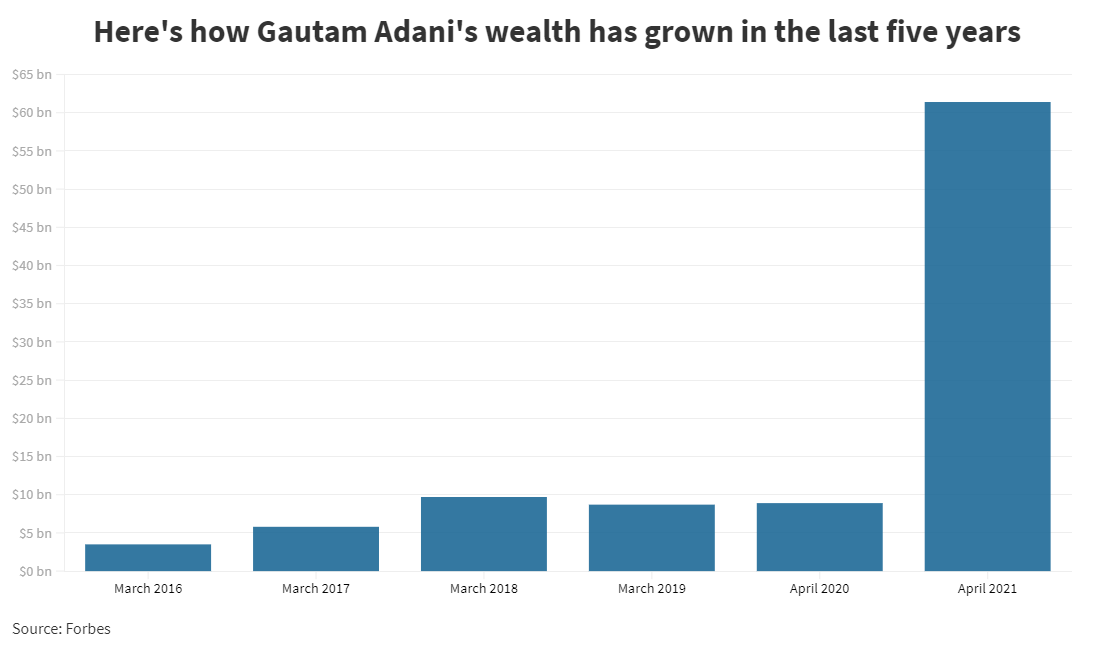

Gautam Adani’s life and times are examples of how ambition and entrepreneurship can make one move up the social ladder. Quitting college, he managed to convert his early struggles into stepping stones towards becoming an industrial czar himself. Nevertheless, despite facing hiccups such as controversies and net worth fluctuations, Adani has grown his fortune impressively, with an estimation of $97.6 billion as of 2024. His determination has ranked him as Asia’s second wealthiest man and placed him within the top 20 richest people globally.

Gautam Adani : A Financial Blueprint

Gautam Adani’s rise to financial prominence was driven by his massive stakes in diverse parts of his empire’s portfolio. Having built businesses from scratch over time, Adani today owns substantial interests in numerous key firms that cumulatively value to enhance his total net worth.

Breakdowns below provide a detailed examination into what constitute Adani’s wealth:

- This is Adani Enterprises: In his total wealth, this company has a 73% shareholding and he values it at $43.5 billion as its base.

- Adani Power: His power sector dominance is established by Adani’s 70% stake in the firm that has a value of $25.6 billion.

- On its part, its 37% stake currently valued at $13.2 billion demonstrates his inclination to energy solutions when speaking of Adani Total Gas.

- For instance, Adani Energy Solutions with his 73% holding worth about $13.7billion is an attempt to diversify his energy portfolio further.

- Instead, he has got a 53% ownership interest in Adani Green Energy with the market cap of $31.83bn which points out his investments into sustainable sources of energy.

- Moreover, Adani Ports have received 66% shares worth over $32.8bn thereby highlighting how much he has invested in logics and port management sectors.

- Apart from other assets, this wealth also comprises; over $50m in real estate investments, a private jet collection costing about $36m and automobile collections ranging from anywhere between $3 and even up to hundreds of thousands of dollars or more than one million dollars for some models among them.

The Rise of Gautam Adani: From Humble Beginnings to Billionaire Mogul

Gautam Adani’s Early Years: Growing up as a Middle Child in a Humble Family

- Gautam Adani, who was born on June 24, 1962, into a poor family in Ahmedabad, Gujarat state; he happened to be the second oldest of eight children. His father Shantilal and mother Shantaben Adani were small-scale entrepreneurs in the textile industry having migrated from Tharad, North Gujarat. Nonetheless, Gautam did not show any interest in education or taking over his family’s business. Thus, Gautam had an unexceptional academic life at Sheth Chimanlan Nagindas Vidyalaya in Ahmedabad and eventually gave up Gujarati University after two years wishing for a better career than what the textile industry could offer.He chose to pursue a different path by going to Mumbai where he became employed as Mahendra Brothers’ diamond sorter before getting deeper into the corporate world.

Gautam Adani : Moving Towards Business Ownership

When his brother Mansukhbhai purchased the plastic unit leading him to ask Gautam for assistance in managing it was actually his turning point. This also exposed him about worldwide trade intricacies as well as PVC imports hence encouraging self-employment ambitions. By 1985, Gautam Adani began importing primary polymers for cottage industries thereby laying down the foundations of future enterprises.

Adani came back to Ahmedabad after that and started his own company, the Adani Group in 1988. Here began his journey away from diamond trade and the formation of one of India’s largest conglomerates.

Making the Adani Empire

Initially committed to trade, the firm rapidly seized economic liberalization in India by venturing into textiles, agricultural products, and metals.

Adani Group had its turning point in 1994 when Mundra Port was put under its management by Gujarat government on BOT basis. This deal not only laid a foundation for group’s focus on trading but also showed how well connected with governments could accrue substantial benefits for businesses in emerging markets in India.

Gautam Adani’s Strategic Growth and Adani Group’s Development

Presently, APSESZ alone stands as India’s biggest private port operator, making significant contributions to both national economic infrastructure and increasing wealth for Adani.

Gautam Adani Power is Born; Diversification into Coal Trading

Also in 1996, the empire continued expanding with the founding of its subsidiary company called Adani Power. Since then, it has built thermal power plants and has grown into India’s largest private thermal power producer, thereby emphasizing its role as one of India’s key sources of energy. In addition to this, coal trading was initiated by the group in 1999 through which it evolved into a conglomerate with significant infrastructure assets including ports, ships mines and power plants paving way towards global expansion via acquisitions such as Abbot Point Port in Australia (2009) and Carmichael coal mine in Queensland (2012).

Gautam Adani Enterprises and Its Many Subsidiaries

Adani Enterprises is the parent company of Adani Group and it has a portfolio of various subsidiary companies’ which are essential in India’s development. They span across different sectors:

- Adani Airport Holdings: Leads airport operations towards improvement of aviation infrastructure in India.

- Adani Road Transport: Concentrates on road projects that are important for national connectivity.

- Adani Wilmar: It processes food, thereby enhancing Indian’s agribusiness industry.

Other subsidiaries like Adani Cement, Adani Defense & Aerospace, and AdaniConneX among others show the company’s strategic choice of diversifying its operations to assist Indian economic growth in several other areas.

Visionary Goals and Global Presence

Gautam Adani’s Adani Group aims to top the solar power industry by 2025. They also aim to lead in renewable power by 2030. This shows how much he is committed to environment friendly growth as well as quick response on global energy problems. Despite recent financial turmoil that impacted revenue temporarily, the influence of Adani Group goes beyond the borders of India with presence in fifty countries globally.

Gautam Adani : Financial Empire and the Hindenburg Research Controversy

The Foundation of Adani’s Wealth

The recent financial legal battles and controversies that hit Adani Group, particularly regarding its money transactions presented major tests. Adani Group’s stock prices rose when certain issues were resolved in their favor. This shows Gautam Adani’s ability to bounce back and make strategic decisions. The Group grows and adds variety to its projects, globally. Gautam Adani’s journey from a dreamer to a worldwide industry heavy-weight, highlights ambition, creativity, and smart growth.

What Provides the Basis for Most of His Fortunes

Gautam Adani is known as one of India’s richest man with substantial investments in six listed units within his conglomerate. They are considered as some of his well-diversified portfolios across industries. This is because they include areas like ports management, electricity generation among others. It also includes cumulative market capitalization worth around 160 billion dollars making him one among world’s wealthiest individuals. He owns up to 37% shares in these firms that form part of his current net worth which ranges from $73 million to $14 billion. These companies include:

- **Adani Enterprises**-owns 73 percent.

- **Adani Power**: Where he holds a 70% stake.

- **Adani Total Gas**: Subsidiary in which he has a 37% stake.

- **Adani Energy Solutions**: He also has 73 percent of the joint venture company.

- **Adani Green Energy**: It constitutes a majority shareholder with 56 percent of the company’s shares.

- **Adani Ports & Special Economic Zone Ltd**: With a 66% stake and others.

injunction, by halting any further release, advertisement or publication of the Research Report.

Notably, questions arose about Hindenburg’s motivation as it had an interest to see Adani stocks decline in value. This report had a great impact on investor confidence because there was no doubt about its intention.

Nevertheless, India’s Supreme Court later ruled that probes into Adani Group be concluded because they asserted there wasn’t any need for further investigations. This decision was welcomed by Adani who saw it as a vindication of his firms’ integrity. This led to an immediate recovery in share prices thus restoring momentarily Asias richest man title back to Adani.

A Constant Bickering with Mukesh Ambani

Over time, these two moguls have shared this crown sometimes on insignificant margins involving their net worths while fighting. However temporary setbacks incurred due to scandal show the resilience of Adanis financial empire and subsequent regaining of his stocks highlights its fluidity.

Gautam Adani’s Increasing Wealth and Charitable Works.

The Restoration of Adani Group Stocks

The rise in Adani Group shares suggests recovery from tough times for the conglomerate. In early 2024, Gautam Adanis fortunes jumped by an astonishing $13.3bn thanks to huge comeback by Adani stocks. In two days only, this wealth gain is the most pronounced in 2021 – thereby signifying a strong comeback for both the businessman himself and his companies.

Visionary Philanthropist Gautam Adani

In 1996, with the intention of growing society, Gautam Adani formed the Adani Foundation within his corporate house. The foundation has been involved in several projects across India that include education, health care, sustainable living and community infrastructure enhancing as it aims to facilitate long-lasting growth in India. This foundation has initiated free schools for underprivileged children across various places such as Bhadreshwar and Ahmedabad among others.

It also played an instrumental role in setting up Gujarat Adani Institute of Medical Sciences, which the Foundation did together with the Government of Gujarat.

The major projects undertaken by this foundation include:

- – SuPoshan: An initiative to address malnutrition in pregnant women and young girls.

- – Udaan: A program that offers educational trips to students to enable them to gain wider exposure.

- – Saksham: Focused on skill development and vocational training, especially for women who head organizations.

To respond to COVID-19 crisis Adani Foundation gave $13million towards PM CARES Fund and a handsome donation was also made to Maharashtra CM Relief Fund thus highlighting how urgent societal issues are not ignored by the foundation in any way shape or form.

In order to mark Gautam Adani’s 60th birthday, Priti Adani (wife) announced a commitment of $7.7 billion from the foundation as an example of such philanthropy underpinning the Adani legacy.

Investments and Lifestyle of Asia’s Wealthiest Man

Gautam Adani’s investment portfolio is thus largely unknown, and so are his lifestyle preferences; however, the ownership of luxurious mansions and fancy cars hints on an opulent life. Among his treasured properties is his home in Gurgaon, Delhi which has been ranked as the city’s most expensive costing about $48m. Additionally, Adani has a residence in Ahmedabad at the heart of his business empire although little about this property has been published.

The Luxurious Life and Key Entrepreneurship Lessons from Gautam Adani

Gautam Adani’s Highly Regarded Collection of Cars

Gautam Adani, synonymous with luxury and sophistication, possesses a large collection of high-end automobiles reflecting his love for lavishness. Some examples include 2008 Ferrari California (Speed icon and Italian craftsmanship), BMW 7 Series (Ultimate in automotive luxury), Range Rover LWB (Combination rugged looks with elegance), Rolls Royce Ghost (Timeless symbol of luxury) or Toyota Alphard (Versatile comfort). All these models have an approximate worth ranging between $300k – $650k implying that they are all high quality vehicles.

The Greatness of Exclusive Flying

Adani’s luxurious way of life covers the air space; he owns a Bombardier Challenger 605 and an Embraer Legacy 650 among other business jets. These planes are estimated to cost in tens of millions, but they do not just transport people – they demonstrate Adani’s importance in the world of business by allowing him to accelerate his activities globally.

It highlights what vision really means – college dropout building global empires – determination or taking risks. Besides dreaming big, Adani has shown that growth must be pursued relentlessly.

Moreover, Adani’s diversification strategy addresses a crucial point on risk management. Amongst other things, you can understand that investing in different sectors helps to reduce risks associated with market volatility thereby ensuring sustainable development of a conglomerate.

Gautam Adani’s Strategic Mastery in Infrastructure and Economic Contribution

The Focused Strategy of Government Contracts and Infrastructure

Gautam Adani’s strategic focus on securing government contracts and spearheading construction of infrastructure such ports, logistics networks and airports demonstrates his business acumen. This shows the visionary approach that enhances critical infrastructure components but is also in line with national economic development objectives. It therefore follows that his combination of business interests with public welfare initiatives represents a win-win situation demonstrating how private entrepreneurship contributes to the country’s progress.

Gautam Adani : Economic Impact and Job Creation

The impact of Adani’s investments goes beyond making money; it creates huge amounts of riches and provides large-scale job opportunities. Adani demonstrates through his conglomerate, the tremendous effects that entrepreneurs can have on promoting economic growth and driving social change within their countries. His story brings out the ability of business leaders to foster economic growth and create jobs; thus justifying the importance of private sector dynamism for a nation’s prosperity.

Adaptability as a Cornerstone of Success

An important aspect of Adani’s success that has been enduring is his exceptional adaptability in response to the market’s movement. This can be seen from moving towards environmentally friendly sources of energy or changing logistics with the new trends. This illustrates that Adani aligns his firm’s growth strategies with emerging realities which show how adaptability drives relevance and sustainability in business over time. It is an important lesson for entrepreneurs and industry players who need to understand that flexibility and innovation are vital drivers of growth and competitiveness.

Gautam Adani : Crisis Management and Resilience

Adani’s journey was not without challenges. In January 2023, there was a great deal of difficulty following allegations of financial wrongdoing levelled at him. Nevertheless, this experience highlights Adani’s resilience in facing up to these accusations head-on and his unwavering resolve. His crisis management capability was underlined after he emerged stronger afterwards, which points out the importance of persistence coupled with resilience when it comes to surmounting obstacles offering encouragement to people as well as firms undergoing dramatic transitions.

Conclusion: A Testament to Visionary Leadership and Resilience

Gautam Adani’s incredible journey from an optimistic businessman to a worldwide economic titan displays how strategic foresight, economic impact, adaptability and resilience work together. His concentration on infrastructure development and adherence to national development objectives give a model for purposeful entrepreneurship. Furthermore, his experience points out the importance of acceptance change. Also, it shows that he is persistent during crises and the transformative part that visionary leadership plays in propelling corporations and society further ahead. Adani’s legacy acts as a guide for both aspirants in business world and existing bosses. It also proves that they are the correct strategy mixed with determination is enough to succeed even when faced with difficulties.